Invoice Settings¶

Overview¶

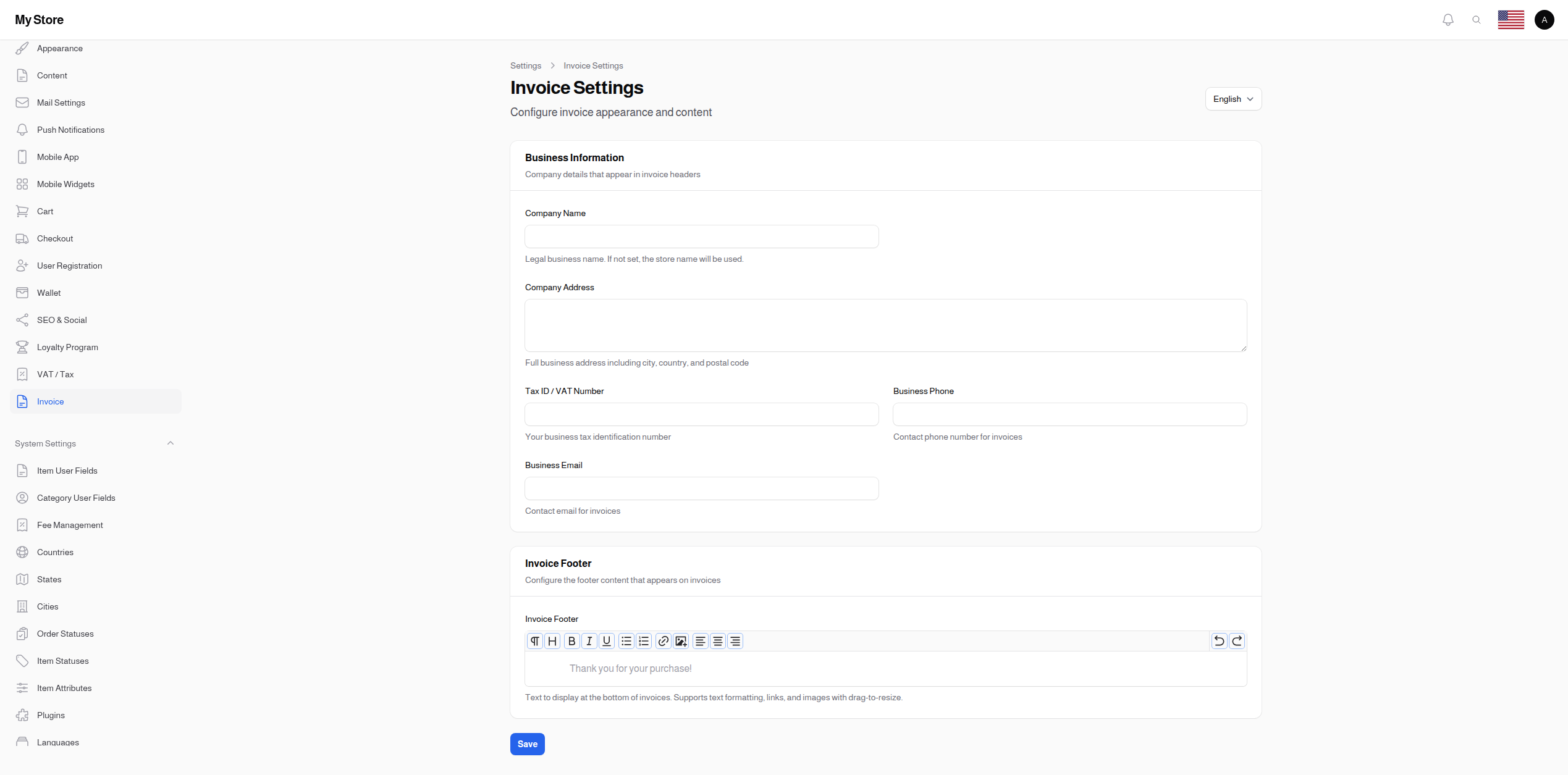

Invoice Settings configures the company information and footer content that appears on your invoices. Ensure your invoices contain all legally required business information.

Accessing Invoice Settings¶

Navigate to: Settings > Invoice from the sidebar menu

Business Information¶

Company details that appear in invoice headers.

Company Name¶

- Type: Text input

- Maximum Length: 255 characters

- Translatable: Yes

- Purpose: Legal business name on invoices

Usage:

- Appears at top of invoices

- Official business identification

- May differ from store name for legal purposes

Fallback: If not set, the Store Name from General Settings is used.

Examples:

- "ABC Trading Company LLC"

- "Fashion Boutique FZE"

- "Tech Solutions Ltd."

Company Address¶

- Type: Multi-line text area

- Rows: 3

- Translatable: Yes

- Purpose: Full business address on invoices

What to Include:

- Street address

- Building/suite number

- City

- State/Province

- Postal/ZIP code

- Country

Example:

123 Business Tower, Floor 5

Al Olaya District

Riyadh 12211

Kingdom of Saudi Arabia

Tax ID / VAT Number¶

- Type: Text input

- Maximum Length: 100 characters

- Purpose: Business tax identification number

Importance:

- Required for tax compliance

- Validates tax-exempt purchases

- Professional appearance

Examples by Region:

| Region | Format | Example |

|---|---|---|

| Saudi Arabia | 15-digit VAT | 310123456700003 |

| UAE | TRN | 100123456700003 |

| UK | GB + 9 digits | GB123456789 |

| EU | Country code + number | DE123456789 |

Business Phone¶

- Type: Phone number input

- Maximum Length: 50 characters

- Purpose: Contact phone for invoices

Usage:

- Customer inquiries about invoices

- Business contact information

- Professional appearance

Format: Include country code for international clarity

Example: +966 11 123 4567

Business Email¶

- Type: Email input

- Maximum Length: 255 characters

- Purpose: Contact email for invoices

Best Practices:

- Use professional domain email

- Consider using [email protected] or [email protected]

- Avoid personal email addresses

Example: [email protected]

Invoice Footer¶

Invoice Footer Content¶

- Type: Rich text editor (TipTap)

- Translatable: Yes

- Purpose: Custom content at bottom of invoices

Editor Features:

- Headings

- Bold, Italic, Underline

- Bullet lists, Numbered lists

- Links

- Images (with drag-to-resize)

- Text alignment (left, center, right)

What to Include:

- Thank you message

- Return policy summary

- Payment terms

- Bank account details (for bank transfers)

- Social media links

- Legal disclaimers

- QR codes (as images)

Example Footer:

Thank you for your purchase!

Payment Terms: Due upon receipt

Returns: 14-day return policy for unused items

For questions about this invoice, contact [email protected]

Follow us: @mycompany on Instagram

Image Support¶

The footer editor supports images:

- Accepted Formats: JPEG, PNG, GIF, WebP

- Maximum Size: 2MB per image

- Storage: Uploaded to

invoice-footer-attachmentsdirectory - Resizing: Drag corners to resize in editor

Use Cases for Images:

- Company logo (additional placement)

- QR codes for payments

- Certification badges

- Bank logos for transfer info

Invoice Preview¶

Your invoice will include:

Header Section¶

- Company Name (or Store Name)

- Company Address

- Tax ID / VAT Number

- Business Phone

- Business Email

- Store Logo

Body Section¶

- Invoice number and date

- Customer information

- Order details and line items

- Tax breakdown (if tax enabled)

- Total amount

Footer Section¶

- Custom footer content (from settings)

Legal Compliance¶

Required Information (Varies by Jurisdiction)¶

Most jurisdictions require invoices to include:

- [ ] Seller's legal name

- [ ] Seller's address

- [ ] Tax registration number

- [ ] Invoice number (unique)

- [ ] Invoice date

- [ ] Buyer's details

- [ ] Description of goods/services

- [ ] Quantity and unit price

- [ ] Total amount

- [ ] Tax amount and rate

VAT Invoice Requirements¶

For VAT-registered businesses:

- Tax ID must be visible

- Tax breakdown required

- Consider including QR code (required in some regions)

Record Retention¶

Invoices are stored in the system. Consult local regulations for required retention periods (typically 5-7 years).

Configuration Examples¶

Complete Business Invoice¶

Company Name: ABC Trading LLC

Address: Tower 5, Floor 10, Business Bay, Dubai, UAE

Tax ID: 100123456700003

Phone: +971 4 123 4567

Email: [email protected]

Footer: Thank you for your business! Payment due within 30 days.

Minimal Configuration¶

Company Name: [Leave empty - uses Store Name]

Address: [Leave empty]

Tax ID: [Leave empty if not registered]

Phone: [Leave empty]

Email: [Leave empty]

Footer: Thank you for your purchase!

Saving Changes¶

Click the Save button at the bottom of the page to apply your changes.

Note: Changes affect new invoices only. Previously generated invoices retain their original information.

Related Sections¶

- VAT / Tax Settings - Configure tax rates

- General Settings - Store name and logo

- Orders - View and print invoices